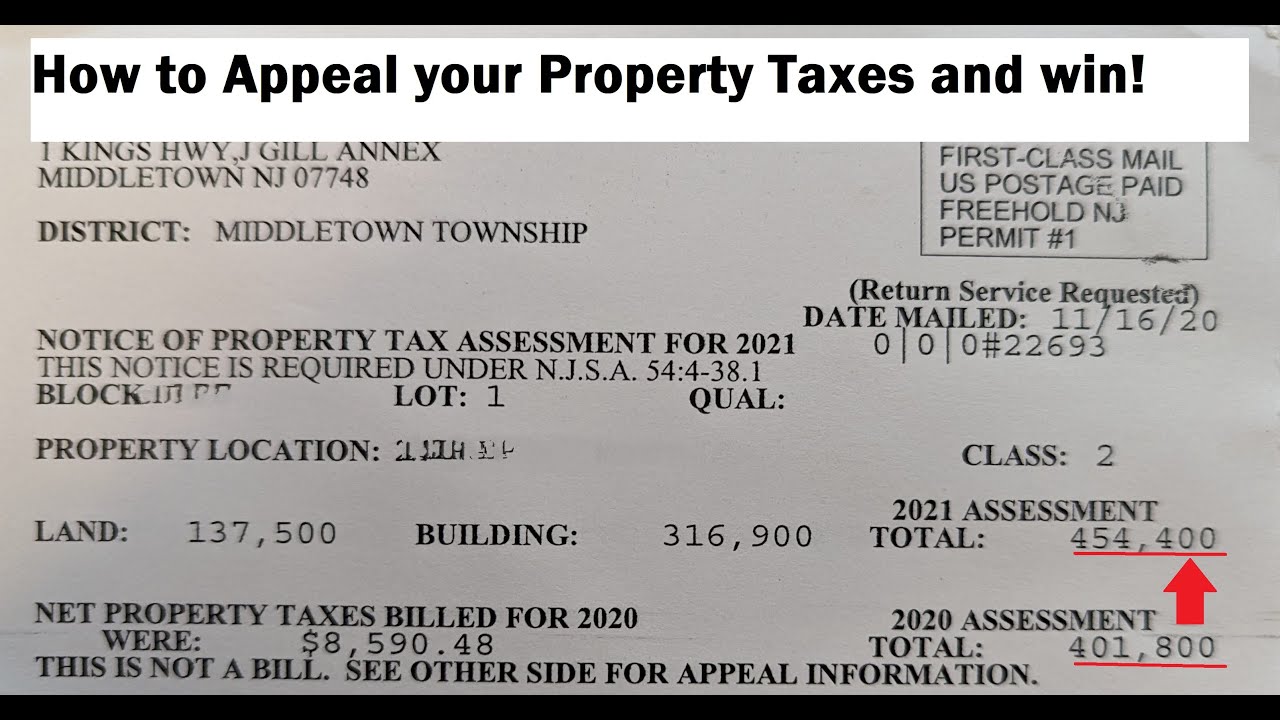

Simple Info About How To Appeal Property Tax Nj

If the property is assessed for more than $1,000,000.00 the taxpayer can appeal directly to the n.j.

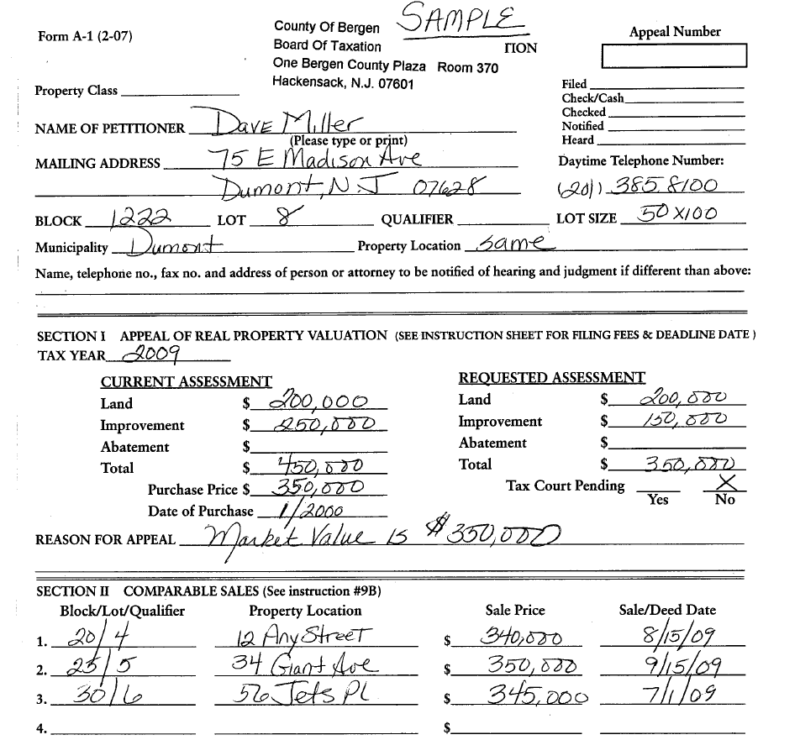

How to appeal property tax nj. A recent appraisal of your home. State of new jersey division of taxation conference and appeals branch po box 198. If you are dissatisfied with the judgment of the bergen.

If the petition of appeal form is downloaded, remember that one copy must be served on the mercer county board of taxation at 640 south broad street,. Filing for a property tax appeal requires strict adherence to governmental policies and deadlines. However, if you decide to appeal your property tax assessment below are some documents you will need:

A guide to tax appeal hearings; Include any relevant attachments with your appeal, such as an appraisal or photos of the property. Homeowners aged 65 or older.

Cook county also gives you a free tool to locate and attach comparable. If the county assessed your property value at $750,000 or. Our mission is to facilitate secured and efficient electronic filing and management of property assessment.

Check should be made payable to: Welcome to nj online assessment appeals. A contractor’s report showing repair.

Active military service property tax deferment application. By mail mail your protest and request for informal conference to: How can i lower my property taxes in nj?

While the tax rate in saddle river is one of the best in new jersey, many homes are currently. Filing a property tax appeal in new jersey is based on two standards: Income and expense statement (pdf) taxpayers bill of rights (pdf).

The court will hold a hearing to determine whether the property assessment stands or qualifies for adjustment. In new jersey, appeals generally must be filed on or before april 1st, or within. File your appeal with tax court.

$250 real property tax deduction supplemental income form. All property owners have the right to file tax appeals with the county board of taxation, regardless of the amount of their assessment. True market value standard —all assessments must be 100% of true market value as of october 1 of the previous year.

Appeal on classification $ 25.00 (c) appeal on valuation and classification sum of (a) and (b) (d) appeal not covered by (a), (b), and (c) $ 25.00.